are 529 college savings plans tax deductible

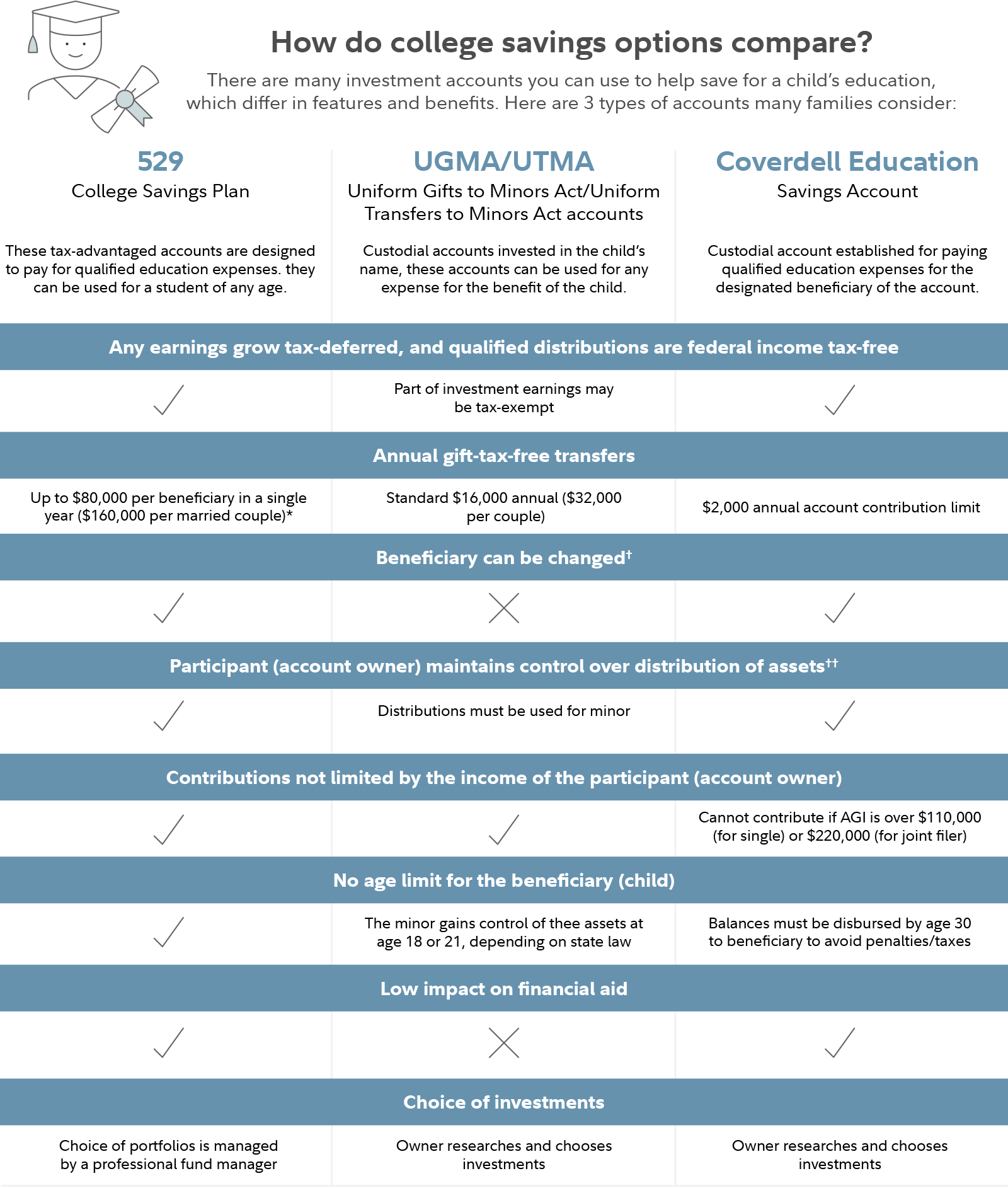

A 529 plan is a tax-advantaged savings plan designed to cover qualified education expenses. There are any number of reasons to love 529 plans as a college savings option such as the lack of federal income tax and the flexibility to add or invest money how you see fit but some.

:max_bytes(150000):strip_icc()/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

How Virginia S 529 Education Savings Plan Works

Unfortunately Kentucky does not offer any.

. 529 Tax Benefits for Kentucky Residents. Colorados 529 tax deduction For Colorado taxpayers contributions to ANY CollegeInvest savings account are eligible for a deduction from your Colorado state income tax return 1. Incoming rollovers from other states 529 plans are accepted.

The Maryland 529 plan tax deduction is a Maryland state tax deduction you can receive for money you contribute to your Maryland 529 college plan savings and prepaid in. The Path2College 529 Plan is. With a state-sponsored 529 College Savings Plan your contributions can grow tax-deferred some states allow.

529 plans offer big tax savings for education 529 savings accounts are an incredible tool that provides savers with a combination of state income tax deductions tax. As long as you. Yes grandparents can claim the deduction for contributing to a 529 if they live in one of the 34 states that offer a state income tax deduction for 529 college-savings plan.

The Path2College 529 Plan operated under the Georgia Office of the State Treasurer gives you a way to start saving today to prepare for a childs tomorrow. 529 plans offer unsurpassed income tax breaks. Kentucky offers tax benefits and deductions when savings are put into your childs 529 savings plan.

529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room. Beneficiaries can hold multiple 529 plans and use the funds within to. The portion that is principal or contributions may qualify for reducing your Wisconsin taxable income including carry-forward.

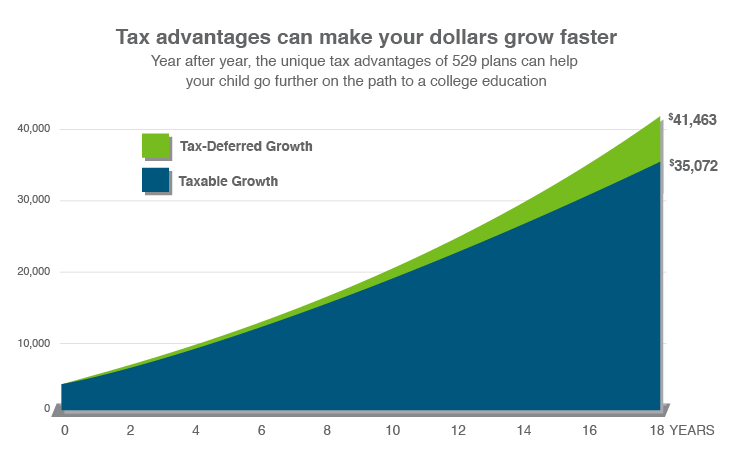

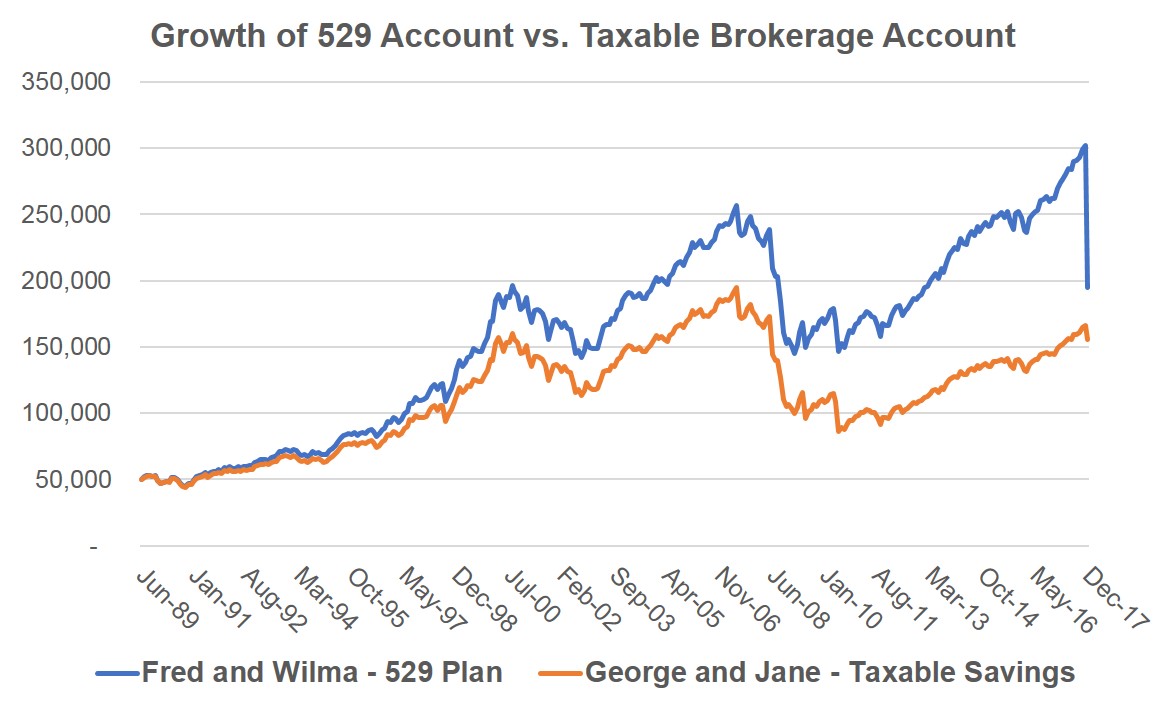

Tax-deferral can have a dramatic affect on the growth of an investment. A Section 529 college savings plan is a tax-advantaged state-administered investment program that is authorized under Internal Revenue Code Section 529. Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out.

NEBRASKA with the NEST Direct College Savings Plan taxpayers can deduct up to 10000 in contributions from their Nebraska taxable income each year 5000 if married filing. For both types of 529 plans contributions are not tax-deductible for your federal taxes although some states provide a state tax deduction for contributions. These plans allow participants to.

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Can You Get A 529 Plan Tax Deduction

:max_bytes(150000):strip_icc()/iStock-485330694.college.plan-a65a644a276a4914a2c4adf677e443a0.jpg)

529 Plan What It Is How It Works Pros And Cons

Louisiana S Student Tuition Assistance Revenue Trust

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

What Is A 529 Plan What Are The Tax Advantages Mybanktracker

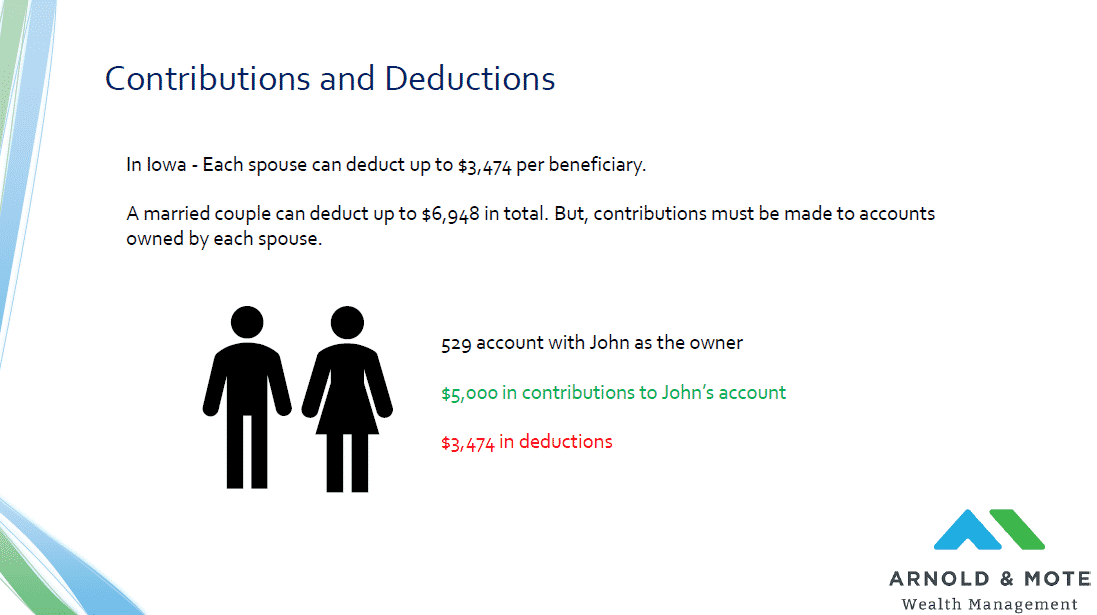

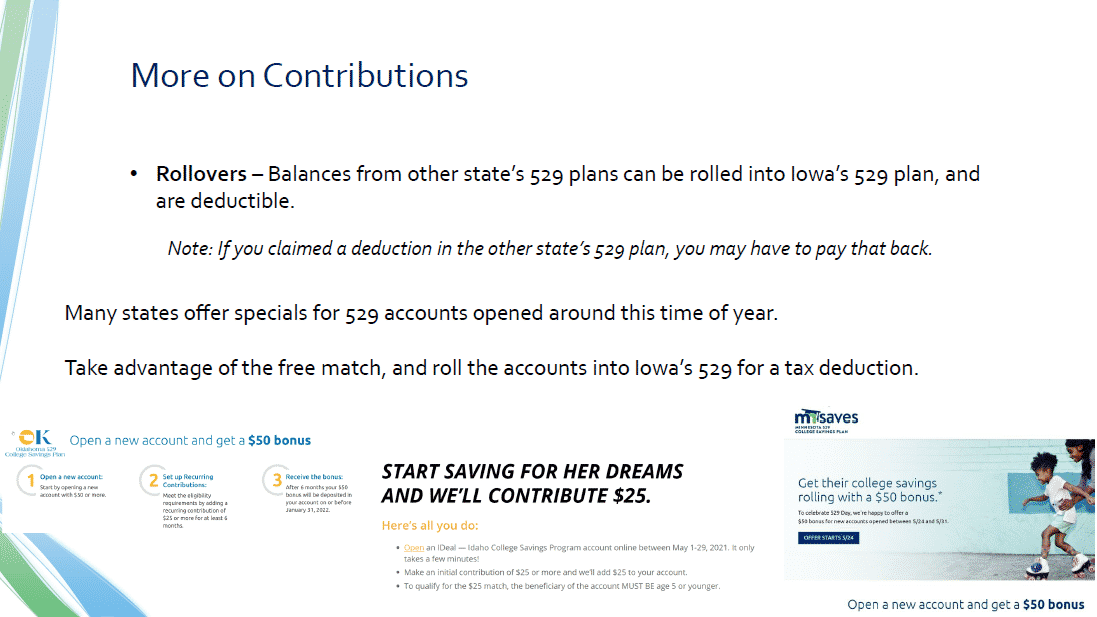

Iowa 529 Beyond The Basics Of Iowa S College Savings Plan Arnold Mote Wealth Management

Taxes Faqs Oregon College Savings Plan

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

What Is A 529 College Savings Plan How Does It Work Titan

Iowa 529 Beyond The Basics Of Iowa S College Savings Plan Arnold Mote Wealth Management

Astute Savers Don T Just Use 529 Plans For College Savings

Michael W Frerichs Illinois State Treasurer College Savings

How Much Are 529 Plans Tax Benefits Worth Morningstar

What Tax Incentives Exist To Help Families Save For Education Expenses Tax Policy Center

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance